Monday, July 1

Trades Taken

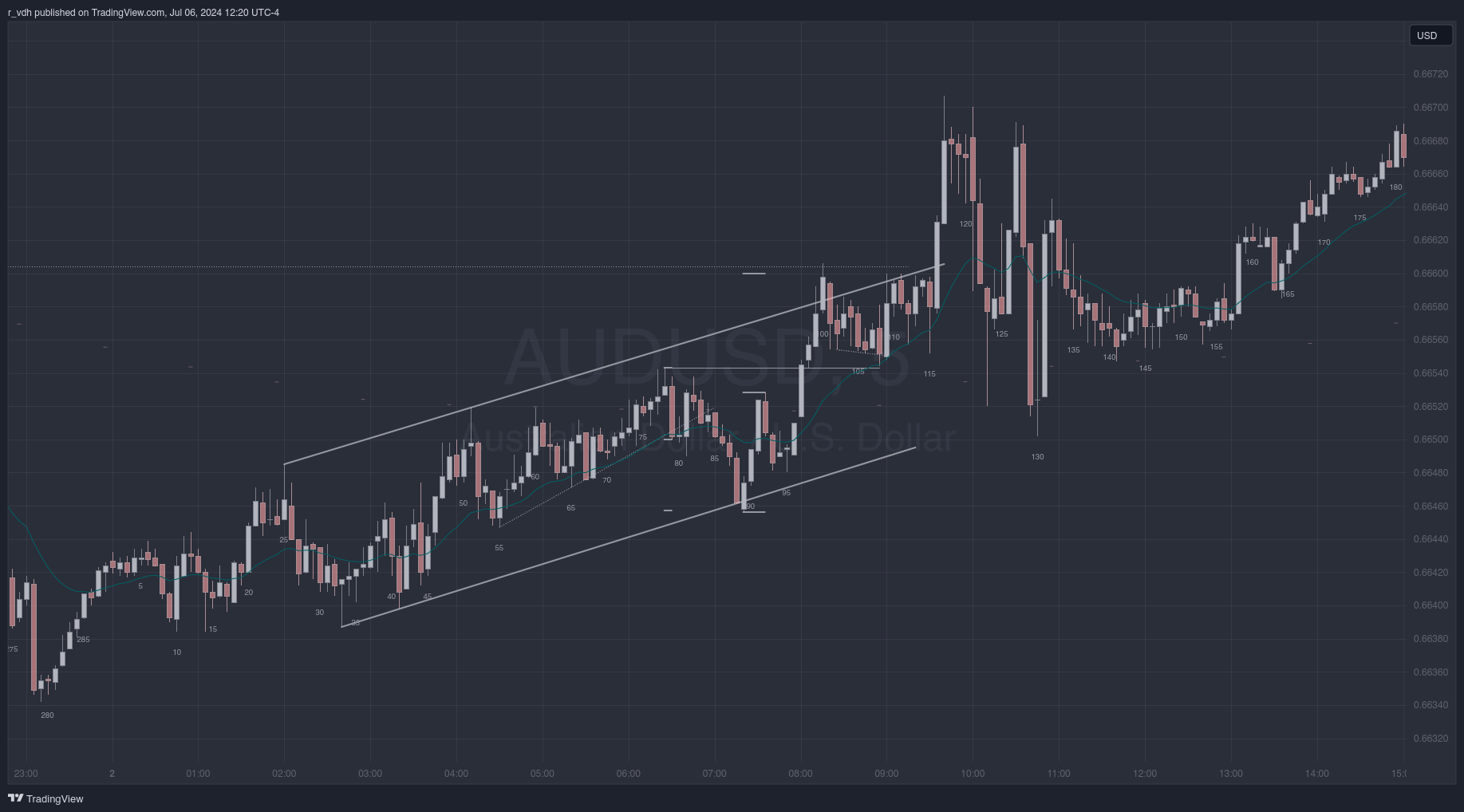

I bought the close of bar 101 and used a measured move projection for my stop loss. The measured move was calculated from the bar 90 breakout point to the bar 101 low, which was exactly 8 pips. I gave myself an extra pip of margin and placed my stop 9 pips below the bar 101 low, at 0.66542. The market fell 7 pips before reversing, which scared me enough to adjust my profit to break even. It would have been a great trade, but I didn’t exited too soon.

Trades Not Taken

I woke up late and opened up the charts around bar 58 as the wedge top was forming. Not having had enough time to feel comfortable with what was going on, I didn’t take the trade to sell the wedge failure at bar 60 with a profit target at the bottom of the trading range. Seems reasonable, but in reality how much did I really need to think about this trade? I should have looked left, seen the trading range top and botttom, then noticed the market was forming the wedge at the top of the range, and placed the order to short as soon as bar 60 dropped below the low of the prior bar.

I also could have shorted the close of bar 62 because at that point the market was always-in short. Stop loss would have been one pip above the bar 59 high.

Other missed trades were the bar 72 low 2, the bar 78 low 1, the bar 88 low 2, and the bar 94 low 3. Shorting bars 94/95 seemed risky at the time, but the bulls had not been able to form a moving average gap bar yet and had only just gotten their first trend line break, so shorting there was still a good bet. I obviously wouldn’t have taken all those trades, but I should have at least taken one or two or them.

Tuesday, July 2

Trades Taken

I sold bar 88 as it went below the prior bar. Not sure what I was thinking. We were in the beginning of a strong bull trend, so what am I shorting for?

I tried shorting again at bar 104. The bar 100 high topped out at a previous level of resistance and closed at the measured move target from the previous spike that ended at bar 91. At exited the trade during 105 at break even. I could have stayed in for a couple more bars and exited at the close of bar 108 when it completed the wedge.

Trades Not Taken

The best trades were the bar 56 high 2, the bar 88 buy-the-close, and the bar 109 high 3.

I was looking at the bars 55-78 channel and seeing it as a bear flag, which was correct, but the small bear trend which resulted from that channel breaking down was only a corrective move to the bottom of the wider bull trend which was forming. I viewed the bar 79 bear spike as evidence of a problem with the bull trend as a whole, and it was indeed the spike in a spike-and-channel bear trend, but it ended at the bottom of the wider bull trend.

Then, when bar 100 broke above the channel, I was looking for shorts and didn’t notice that the wedge bottom at bar 108 failed to close gap from the breakout point at the bar 78 high.

Wednesday, July 3

Trades Taken

I sold at bar 50 and used a wide stop. A better entry appeared 40 minutes later at bar 58 as the price dropped below the low of the prior bar. The candle followed a moving average gap bar which had occurred five bars earlier. Selling here I could have used a tighter stop and at least scalped a profit equal to my risk. I hoped this bear trend might be the start of a larger reversal of the bull trend from yesterday. I adjusted my stop loss to break even and was forced to buy back my short when the market reversed back up from the lower low major trend reversal that took place at bar 88. I should have gotten out of the trade at least by bar 91, as the LL MTR was more than apparent and it came after the bar 82 moving average gap bar.

Trades Not Taken

The high 3 buy at bar 91 was the obvious trade I should have taken. I was too involved with my short to admit it, but all the signs were there.

- The barbed wire low 2 trading range between bars 61 and 69 is often a final flag

- The clean break of the trend line at bar 81 and the following bar being a moving average gap bar

- The wedge bottom lower low major trend reversal at bar 90

Thursday, July 4

Trades Taken

I shorted bar 80 as it dipped below the low of the prior bar, thinking it was a double top wedge reversal. I neglected the strength of the spike which started at bar 69. Also, I was shorting the first leg of the channel rather than the second. If anything, I should have been looking to short the second leg. Incidentally, that short never triggered, as bars 81-83 formed a triple bottom. There was a much larger wedge being formed by the highs of yesterday’s bar 262, today’s bar 51, and the bar 100 wedge top.

Trades Not Taken

Bar 68 was a high 2 signal bar, as well as being the first moving average gap bar since the bar 48 spike, so a retest of the bar 51 high was likely. Lastly, it was a double bottom with bar 62.

Bar 100 was a low 3 and could have been shorted by bar 102.

Friday, July 5

Trades Taken

None.

Trades Not Taken

Before the huge candle at bar 103, the trading range was too tight to trade profitably. But shorting bar 118 as it fell below the prior bar, or as it fell below the low of bar 115, would have been an acceptable trade.