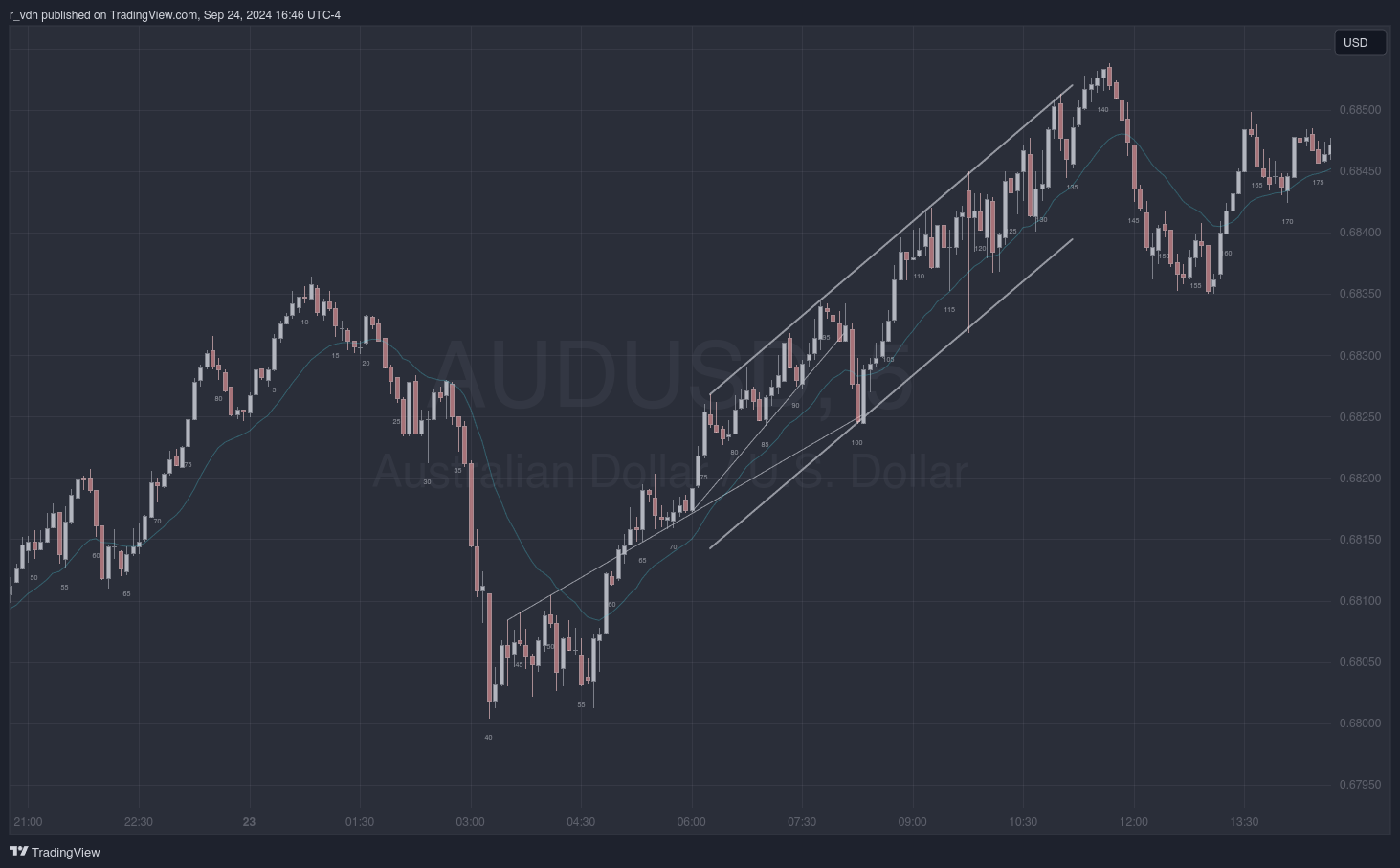

Monday, September 23

Analysis

No analysis provided.

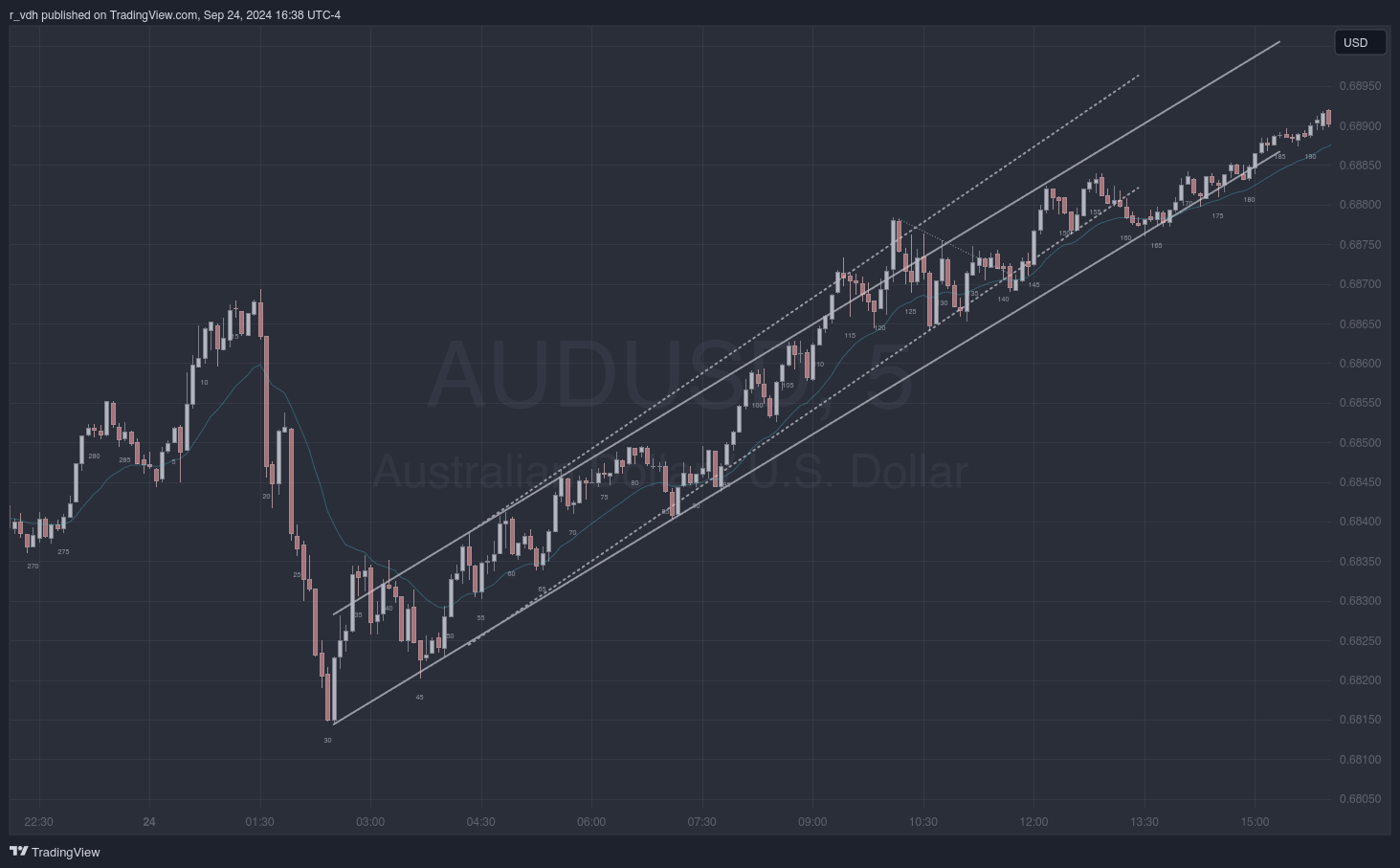

Tuesday, September 24

Analysis

No analysis provided.

Wednesday, September 25

Analysis

Most bear trends should be treated as bull flags, but this one resulted in an acceleration of the trend rather than in a reversal. The bearish spike that broke out the bottom of the range presented no opportunities for longs, so in the context of today that fact didn’t make any difference.

Bars 86 and 97 were acceptable low 3 signal bars, both of which should have used the high of bar 60 for their stop loss. The bar 114 second entry was the signal bar for the bar 111 low 3 The spike up to the bar 102 low 3 was too strong to enter until the second entry triggered at bar 115.

Bar 76 was the third push of a triangle, which is a type of low 3. It generated a profitable trade with a reward over double the initial risk, but only if the trader was willing to hold on to the trade well into the New York session. Realistically, the trade should have been exited at break even as bar 96 went about the high of the prior bar, but the short should have been re-entered as the market turned down from the top of the range at bars 99 or 115 (preferably both). After all, the spike up from bar 95 didn’t change the bearish premise: it only offered better prices.

But why was their a bearish premise to begin with?

My reasons are quaternary:

- Unbroken trend line

- Lack of climactic price action

- Over 100 bars of momentum

- Bars are small

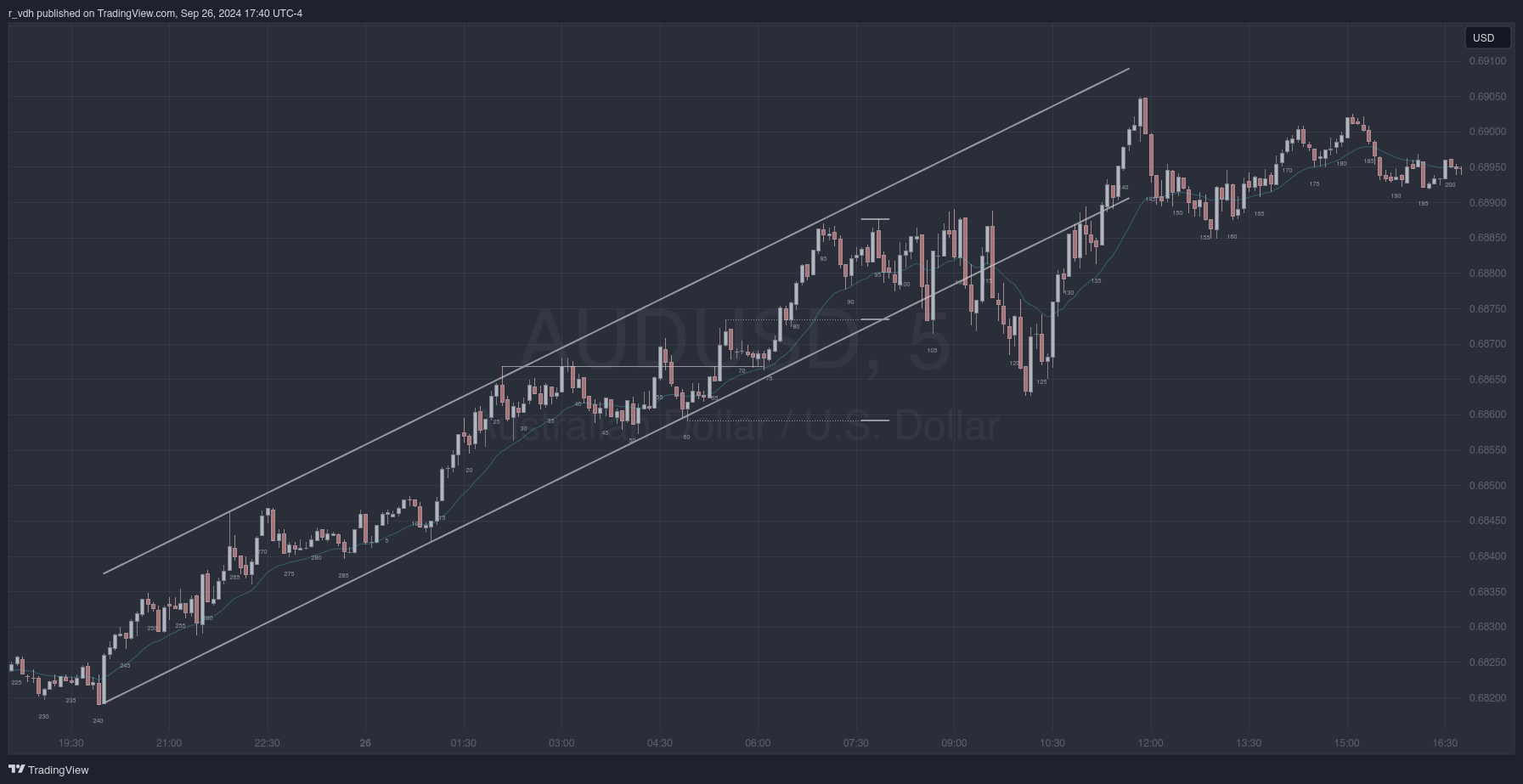

Thursday, September 26

Analysis

No analysis provided.

Friday, September 27

Analysis

The size of the bars kept me away from trades, but it needn’t have. By the bar 54 higher high, the price action was not climactic and there had not been any moving average or trend line gap bars, so buying low 2s and 3s was likely to be profitable.

The bar 63 high 3 signal bar could have been longed, but would have most likely been exited around the bar 72 low 3. The long should have then been re-entered at or after the bar 84 high 2. A stop loss based off of a measured move using the height of bar 84 would have been prudent. The height of that bar was 6.5 pips, so the stop loss would have been placed ~7.5 pips below its low. Those longs could (should?) be exited after the bar 95 low 3 signal bar. The two pushes down which followed the break down of that wedge were very bullish, and astute trades entered longs on bar 103 as it went above the high of the prior bar.

Bar 74 was both a moving average and a trend line gap bar. Why then was the market still bullish?

- Lack of previous climactic price action

- The spike which followed the gap bar took the form of a tight wedge composed of five consecutive bull bars

- Bar 84 was a climactic push down to (without breaking) a level of support1

- Bar 85 was a strong reversal bar

-

This level of support was created by snapping a parallel of the trend channel line to the bar 19 low. ↩︎