Monday, November 24

Trades Taken

None.

Trades Not Taken

The bar 88 wedge bottom was the signal bar for a long – the close of bar 87 could have been bought as well – that targeted the low of bar 37.

Tuesday, November 25

Trades Taken

None.

Wednesday, November 26

Trades Taken

None.

Trades Not Taken

Bar 57 was the third push of a wedge and a short signal bar for a continuation of the bear trend, or – given that it was also a moving average gap bar – at least a final correction before an attemp at a reversal. There as a long entry at the bar 78 close based on a measured move using the bars 62-67 spike. The price did end going slightly lower to complete the leg 1 = leg 2 measured move, but the trade’s stop loss would not have been triggered.

Thursday, November 27 ( 🍂 Thanksgiving 🍂 )

Trades Taken

None.

Trades Not Taken

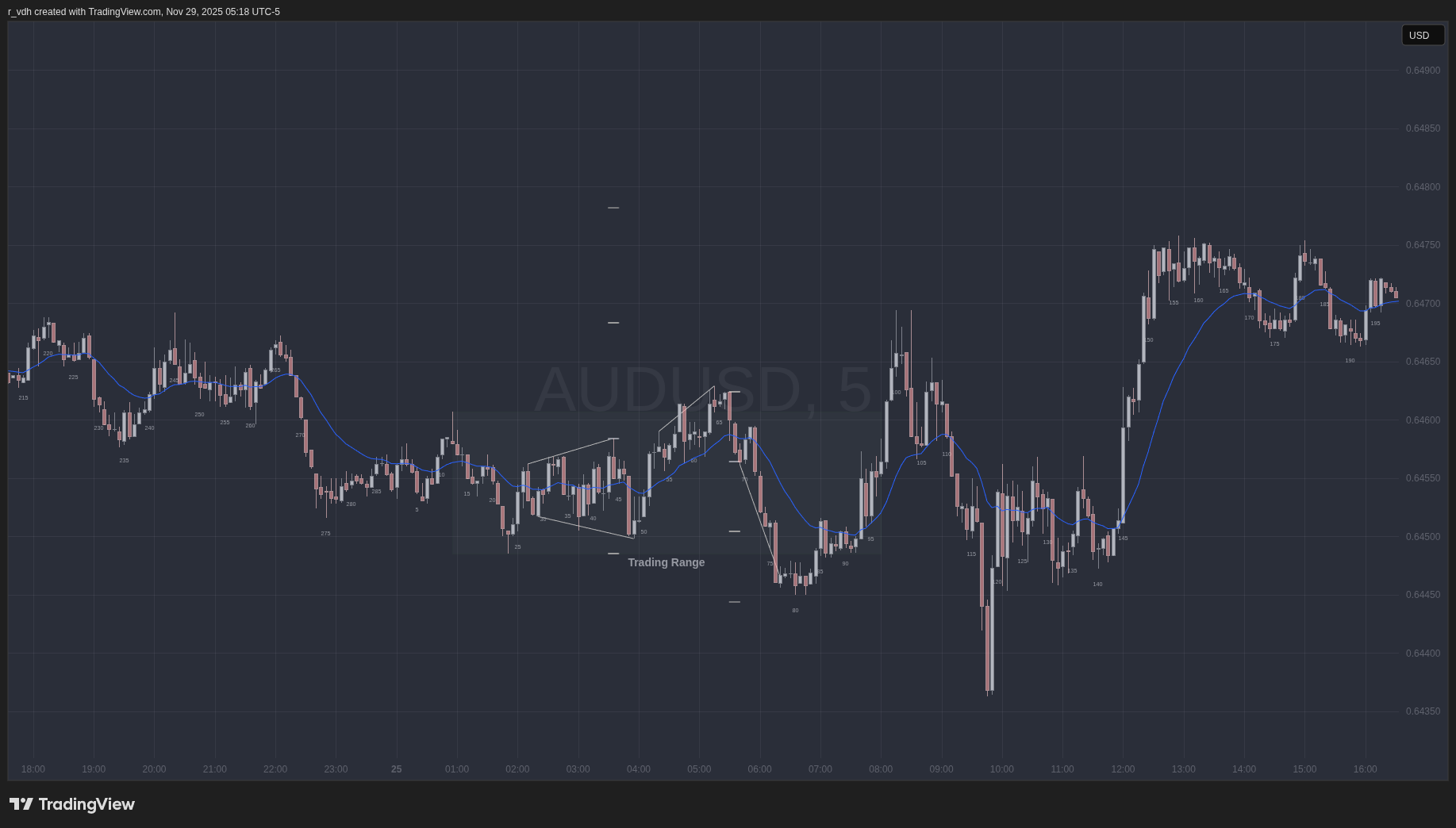

The close of the 2:55AM bar 36 at the London open could have been shorted based on a measured move using the preceding trading range. Bar 66 was a wedge top and the first break of the trend line. The following bar was the short entry for a ten bar, two leg correction. The second (bar 55) and third (bar 66) pushes of the wedge was also a leg 1 = leg 2 measured move (not shown). Lastly, after the trend line break there was a wedge correction setup for a major trend reversal. However, because the market was more or less in a trading range rather than a true bear trend, the reversal was not likely to result in a profit large enough to offset the risk.

The total height of the trading range was only 11.3 pips, so it was difficult to find trades that would result in a large enough price movement to justify entry.

Friday, November 28

Trades Taken

None.

Trades Not Taken

Bar 45 was the third push of a bear wedge and a signal bar for a major trend reversal.